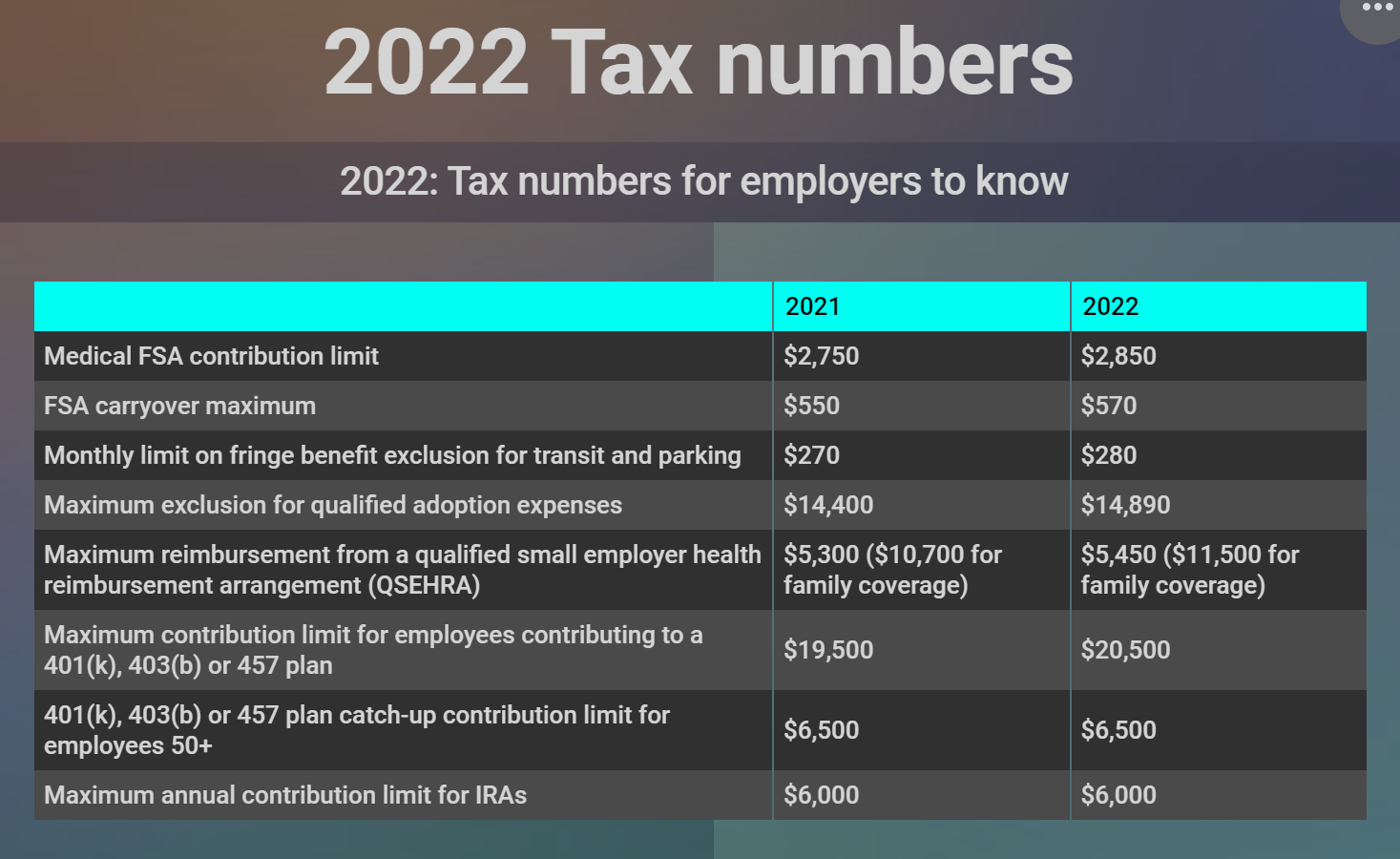

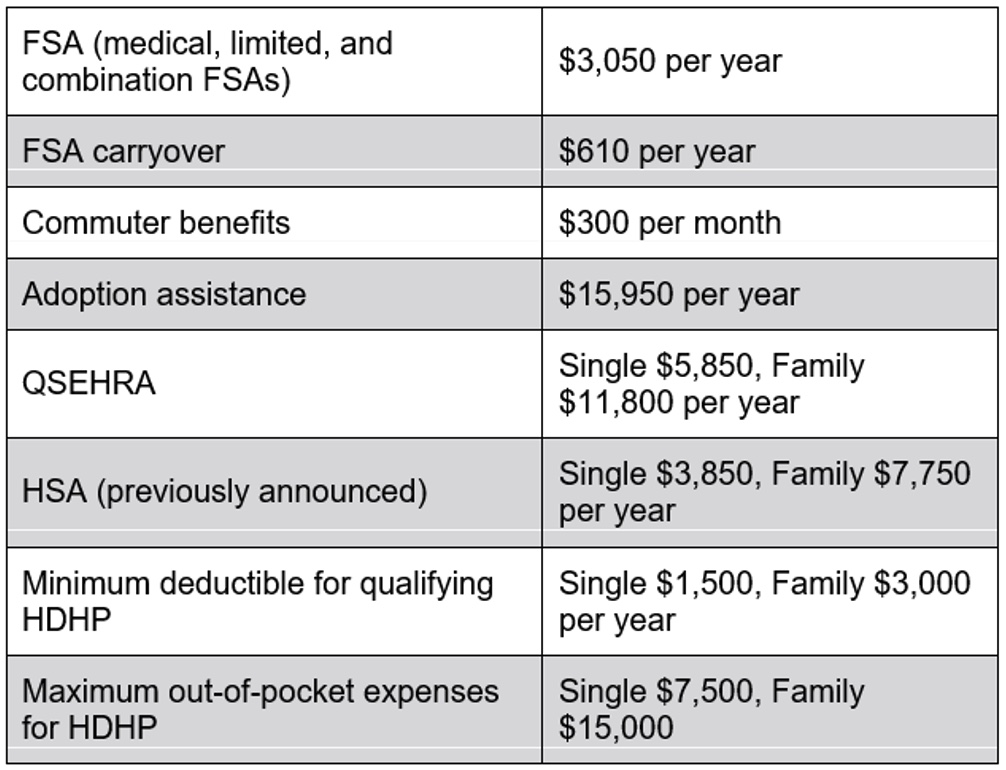

Fsa 2025 Irs Limit. Dependent care fsa contribution limit 2025 school. Each year the irs announces updates to contribution limits for flexible spending accounts (fsa), health savings accounts (hsa), health reimbursement arrangements (hra),.

The income limit for taking a full deduction for your contribution to a traditional ira while participating in a workplace retirement plan in 2025 is $77,000 for single filers and. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll.

2025 Fsa Contribution Limits Irs Babita Rosabella, In 2025, the fsa contribution limit is $3,200, or roughly $266 a month.

Irs Fsa 2025 Limits Marna Sharity, The limit on health fsa carryovers increases to $640 for plan years beginning in 2025.

Fsa 2025 Contribution Limits Arlyn Caitrin, Like the 401(k) limit increase, this one is lower than the previous year’s increase.

Irs Fsa Eligible Expenses 2025 Deni, The irs contribution limit for healthcare fsas is $3,050 for 2025 and $3,200 in 2025.

Irs Dependent Care Fsa Limits 2025 Neely Wenonah, On november 9th, 2025, the irs released rev.

Max Fsa Contribution 2025 Ethyl Janessa, Healthcare flexible spending account and commuter irs limits.

Dependent Care Fsa Limit 2025 Irs Suzi Zonnya, If the fsa plan allows unused fsa amounts to carry over,.

Fsa 2025 Irs Limit Agatha, The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in.

Irs Dependent Care Fsa Rules 2025 Shawn Dolorita, Here’s what you need to know about new contribution limits compared to last year.