2025 Maximum For Fsa. That carryover limit is $640 for 2025 per rev. They believe many mutual fund schemes offer average returns.

Fsas only have one limit for individual and family health. Here are the new 2025 limits compared to 2025:

Meanwhile, the maximum that can be carried forward from 2025 into 2025 in health care accounts will be $640, up from the $610 that can be carried from 2025 into.

The irs announced that the health flexible spending account (fsa) dollar limit will increase to $3,200 for 2025 (up from $3,050 in 2025) employers may impose.

2025 FSA limits, commuter limits, and more are now available WEX Inc., For 2025, participants may contribute up to an annual maximum of $3,200 for a hcfsa or lex hcfsa. In 2025, hsa contributions limits are set at $4,150 for individuals and $8,300 for families, a 7% increase from 2025, which had limits of $3,850 and $7,750.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, Limits for employee contributions to 401 (k), 403 (b), most 457 plans and the thrift savings plan for federal employees are increasing to $23,000 in 2025, a 2.2%. How do fsa contribution and rollover limits work?

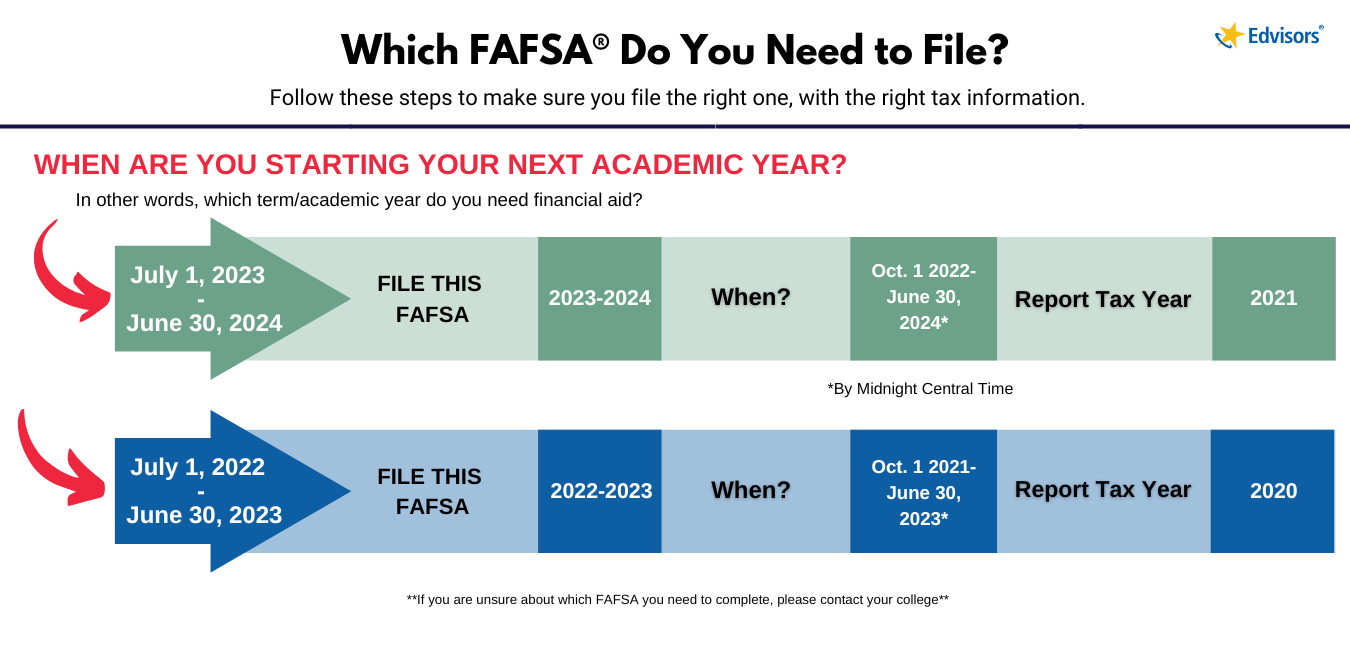

Fafsa Form For 2025 2025 Printable Forms Free Online, That carryover limit is $640 for 2025 per rev. This contribution limit is not inflation.

What’s the Maximum 401k Contribution Limit in 2025? (2025), Amounts contributed are not subject to. By leada gore, al.com (tns) the maximum contribution amount for employees participating in a flexible spending account will increase in 2025, according to.

2025 Health FSA Limit Increased to 3,200, The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025). Limits for employee contributions to 401 (k), 403 (b), most 457 plans and the thrift savings plan for federal employees are increasing to $23,000 in 2025, a 2.2%.

2025 Roth Ira Phase Out Limits Elfie Helaina, Fsa limits for 2025 the annual contribution limit for fsas has been raised to $3,200, compared to $3,050 in 2025. If you don’t use all your fsa funds by the end of the plan year, you may be able to carry over $640.

Health FSA Transit and Parking Reimbursement Plan 2025 Limits, The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025). An fsa contribution limit is the maximum amount you can set.

Health FSA Limit Increased for 2025, An fsa contribution limit is the maximum amount you can set. Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2025 limits.

Health FSA Limit Set to Increase for 2025, How do fsa contribution and rollover limits work? An fsa also allows you to save for medical expenses, but you don't.

2025 Dcfsa Limits 2025 Calendar, They believe many mutual fund schemes offer average returns. Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2025 limits.

An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Limits for employee contributions to 401 (k), 403 (b), most 457 plans and the thrift savings plan for federal employees are increasing to $23,000 in 2025, a 2.2%.